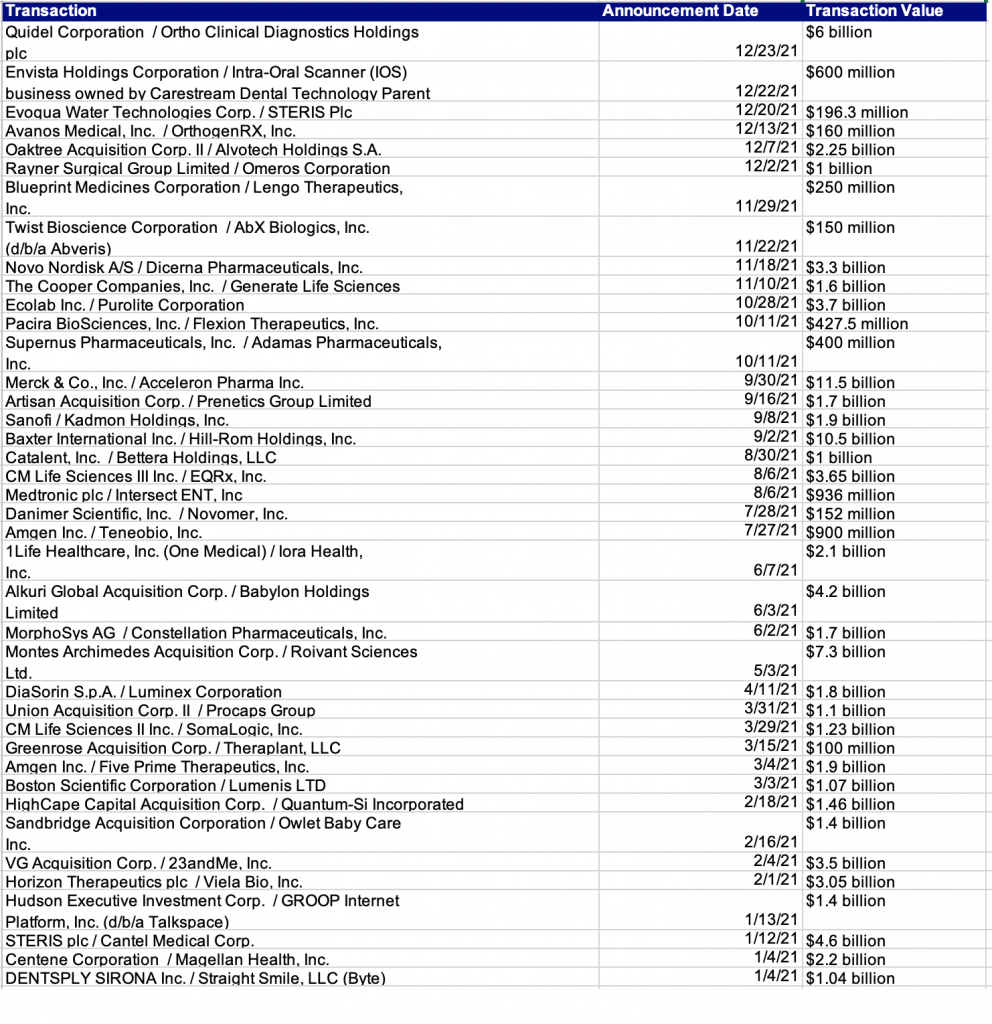

Last year saw 40 transactions in the healthcare industry with a minimum value of $25 million. These range from the smallest at $100 million between Greenrose Acquisition Corp. and Theraplant LLC to the largest deal between Merck & Co., Inc. and Acceleron Pharma Inc. worth $11.5 billion; 27 of these transactions were valued at over $1 billion.

2021 represents a slight decline from prior years in terms of transaction volume. Previously, 2020 saw 44 deals valued at least at $25 million and 2019 saw 48 deals. 2021 has seen a greater number of larger deals, with a median value of $1.53 billion, as opposed to $515 million in 2020 and $562.75 million in 2019.

Average transaction value was $2.34 billion, similar to the 2020 value of $2.85 billion, but down from the 2019 value of $5.15 billion, perhaps driven by the $63 blockbuster merger between AbbVie and Allergan.

2021’s transactions can be distinguished by their subject matter, as the healthcare industry closes out its first full calendar year of the COVID-19 pandemic. The year saw large deals between pharmaceutical companies (often leading to securities litigation) and medical technology companies, such as the $1.4 billion deal for therapy app TalkSpace.

Highlights of pharma industry deals include Novo Nordisk A/S and its deal with Dicerna Pharmaceuticals for $3.3 billion to expand RNAi therapeutics; Merck & Co., Inc. and Acceleron Pharma Inc.’s deal worth $11.5 billion to boost Merck’s cardiovascular segment; and many others listed in full below. EQRx, a pharmaceutical company focused on making medicine affordable, entered into a $3.65 billion deal with life-science focused SPAC CM Life Sciences III, Inc.

Other deals relate to medical technology, like Rayner Surgical’s acquisition of Omeros Corporation’s OMIDRIA intraocular solution for use in cataract surgery or intraocular lens replacement in a $1 billion deal. Additionally, CooperCompanies will acquire Generate Life Sciences in a $1.6 billion deal to expand its offerings for fertility clinics and Ob/Gyns.

It was also a busy year for biotechnology comany Amgen, who engaged in two large acquisitions in 2021. In March, Amgen announced that it would acquire Five Prime Therapeutics, a “clinical-stage biotechnology company focused on developing immune-oncology and targeted cancer therapies,” for $1.9 billion. The transaction will beef up Amgen’s oncology portfolio.

In July, Amgen announced that it would acquire Teneobio, a “clinical stage biotechnology company developing a new class of biologics called Human Heavy-Chained Antibodies,” for $900 million. Accordingly, this will add to Amgen’s antibody research.

Overall, the largest deals were:

- Merck & Co., Inc. and Acceleron Pharma Inc.’s deal worth $11.5 billion to boost Merck’s cardiovascular segment;

- Baxter International’s $10.5 billion deal with Hill-Rom Holdings, which will expand their connected care solutions;

- Montes Archimedes Acquisition Corp.’s deal for $7.3 billion with Roviant Sciences Ltd

- Quidel Corporation’s $6 billion deal with Ortho Clinical Diagnostics Holdings, and

- STERIS plc’s deal with Cantel Medical Corp. for $4.6 billion, allowing Steris to expand its sterilization and surgical product offerings with Cantel, which specializes in dentistry and endoscopy equipment.